Please know that your donation, whatever the size, plays a real part in the success of the School. This vital support will allow future generations to continue to thrive at Gresham’s and make the most of every opportunity.

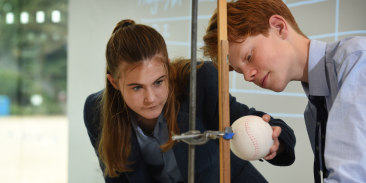

BURSARY FUND

By supporting our bursary fund, you will help ensure more pupils can access an ever-relevant and rewarding education, giving them the opportunity to develop their passions, hone their skills, and aspire to achieve great things once they leave.

THE BRUCE-LOCKHART FUND

By donating to the Bruce-Lockhart Fund you are supporting bursaries at Gresham’s in perpetuity; your support will help to endow bursaries at Gresham’s for local pupils.

FUNDS AND PROJECTS

Whether it is the intricacies of the academic, extra-curricular or pastoral support that the School offers, or the excellent and much used buildings and facilities, so much of what Gresham’s offers today is with thanks to the support of others. Please consider supporting our ambitious plans for the future.

MAKE A ONE-OFF or regular DONATION

We are extremely grateful for the support we receive from all our donors. Whatever the size of the donation and whether a single or regular gift, cumulative support has a lasting and life-changing impact.

OTHER WAYS TO DONATE

CHEQUE / CAF CHEQUES

Please make cheques payable to The Gresham’s Foundation. Download, print and complete our donation form below, which includes a gift aid declaration.

ELECTRONIC BANK TRANSFER

If you would prefer to make a donation via bank transfer, please find the Foundation’s bank details on the donation form.

GIVING

SHARES

Donating shares to The Gresham’s Foundation can be a particularly tax efficient way to support the School. If you would like more information, please contact the Development Office.

The Gresham’s Foundation

Donation Form

GIFT AID

If you pay UK income tax or capital gains tax, we can reclaim from the Government the basic rate of tax which you have already paid on the gift. This currently works out at 25p for every £1 you give.

If you are a higher rate tax payer, you can additionally claim higher tax relief via your Self Assessment tax return. This is the difference between the higher rate of tax and the basic rate. This reduces the cost to you of making the gift.

GIVING FROM THE

UNITED STATES

Donors who are resident in the United States can qualify for an income tax deduction on gifts made to Gresham’s. If you wish to make a gift and take a US income tax deduction, you may make a donation to the British Schools and Universities Foundation (BSUF) Inc.

CONTACT US

For further information or to discuss your donation, please contact Ed Margetson, Director of

Development, on 01263 714529 or email emargetson@greshams.com